Swine Production in Japan: Navigating Shifting Tastes and Environmental Challenges

As Japan navigates the changing tides of dietary preferences and environmental challenges, the swine industry emerges as a significant player in the nation's agricultural landscape. The shifting dietary habits, moving from a traditional seafood-centric diet to increased meat consumption, particularly among younger generations, have placed the spotlight on swine production. This article delves into the state of swine production in Japan as of April 2024, exploring the dynamics of the industry, recent trends challenges and the outlook for the future.

A Shift in Dietary Preferences

Traditionally known for its seafood-rich diet, Japan has seen a steady increase in meat consumption over the past decades, with a notable surge since 2020 as home-cooked meals gained preference during the global pandemic. This shift is largely attributed to the Westernisation of the Japanese diet and changing dietary habits among the younger generation, leading to a decrease in seafood consumption. In contrast, meat, particularly pork, has found its way to becoming a staple in Japanese households. The national statistics reflect this trend, with per-capita consumption of seafood declining steadily over the past two decades and falling below meat consumption levels since 2011.

In Japan, the culinary landscape is rich and diverse, with pork playing a pivotal role in both traditional and modern dishes. Among the myriad of pork brands, Okinawa Agu stands out for its marbled texture that melts in your mouth, offering a unique blend of sweet and savoury flavours ideal for the traditional Rafute dish. Similarly, Kagoshima Kurobuta is celebrated for its exquisite taste and sweet fat, making it perfect for Shabu-shabu. For those seeking a culinary adventure, Kurao Pork, also known as Baumkuchen-ton, offers a distinctive experience with its firm meat enriched by a unique diet including Baumkuchen cake, recommended for Shabu-shabu. Each of these brands reflects the meticulous care in breeding, feeding and environmental management, ensuring a high-quality, flavourful experience that is deeply embedded in Japan's rich food culture.

The Swine Industry at a Glance

Only 20% of Japan's land is suitable for cultivation and the average area of agricultural land per farm entity is 3.1 hectares, which is less than 20% of the typical farm size in the European Union. Although Japan is one of the major importers of pig meat, as of 2022, the total number of sows in the country reached 789,000 heads, indicating the significant scale of the industry.

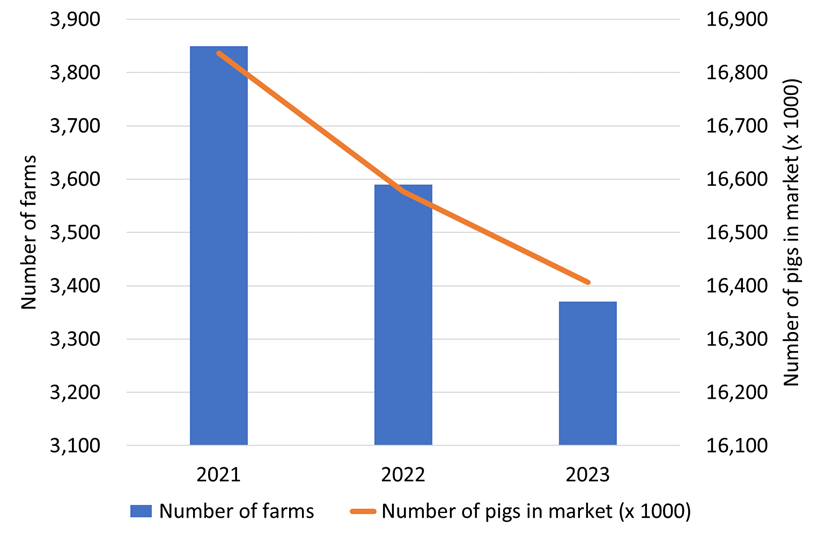

Japanese farms are typically family-owned and swine production is not an exception. There are more than 3,000 swine farms in Japan, and the typical swine farm size ranges between 150 to 300 sows, operating under a farrow-to-finish model. Interestingly, 60% of sow farms in Japan house fewer than 200 sows, highlighting the prevalence of smaller operations. Yet, the definition of a large farm in this context is one that maintains more than 1,000 sows, emphasising the variability in farm sizes across the country. In the last 2 years, while the number of pigs farms dropped by more than 12%, the number of pigs produced only decreased by 2.5%, indicating a trend for larger operations (see Figure 1). The largest company in swine farming owns about 20,000 sows, illustrating the upper echelons of scale within the industry. Although meat packers operate these integrated farms, their overall market share remains a relatively small portion of the total industry. This distribution of farm sizes and types reflects the nuanced and multifaceted nature of swine production in Japan, catering to various market needs and operational scales.

Figure 1: Trends in the Japanese swine industry from 2021 to 2023 (Source: MAFF, Ministry of Agriculture, Forest and Fishery of Japan)

Production performance of Japanese swine industry

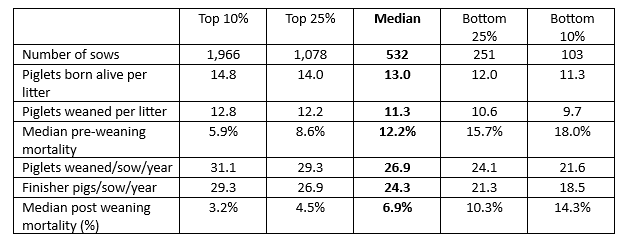

The data from JASV bench marking system (JASV bench marking 2022 data analysis, published by Yosuke Sasaki from Meiji University in Pig Journal, July 2023), is reported in Table 1 and presents a clear relationship between the scale of operations and piglet productivity and survival rates. Top-performing farms likely have access to better resources, genetics and management practices, leading to higher productivity and lower mortality rates. The significant differences in productivity and mortality rates across the spectrum highlight the impact of management practices, scale and possibly technological adoption in Japanese swine production.

Table 1: Production performance in Japan (Source: JASV bench marking system, N=143)

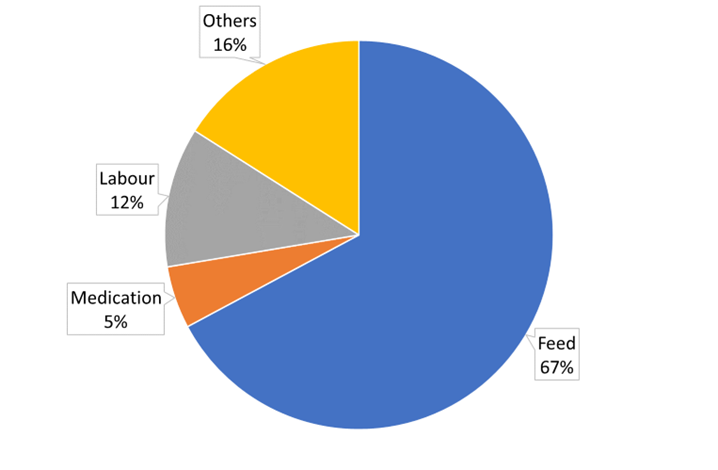

From 2021 to 2022, there has been a substantial increase in production costs, mainly due to higher feed costs, which went up by more than 20%. The latest data available indicates a production cost of about J¥ 43,540 (or € 272) with feed representing almost 70% of the total (see Figure 2).

Figure 2: Share of the total production cost in 2022 (Source: MAFF, Ministry of Agriculture, Forest and Fishery of Japan)

Production Trends and Challenges

The year 2024 is expected to see a slight increase in swine slaughter to 16.85 million from 16.74 million in 2023 (source: https://www.pig333.com/), driven by higher initial stocks due to delayed slaughtering during the hot summer of 2023. This increase is supported by strong pork demand, expected to sustain carcass prices and motivate hog operators to keep production steady.

However, the industry faced significant challenges in 2023, with the summer heat affecting swine weight gain and leading to slaughtering delays. Diseases like PRRS, Classical Swine Fever (CSF) and Porcine Epidemic Diarrhea (PED) also posed threats, although their impact on overall production was limited.

Looking Ahead

Despite inflation, pork consumption in Japan is expected to remain robust in 2024, supported by strong demand in both retail and food service sectors, partly due to increased tourism post-COVID. The demand for pork as a staple in the Japanese diet, particularly for home cooking, has shown to be relatively inelastic to price changes, although there is a noticeable shift towards lower-priced cuts.

As the Japanese swine industry continues to evolve, addressing sustainability, environmental impact and demographic shifts remains critical for future growth and competitiveness. Policymakers are focusing on increasing productivity through innovation, sustainable practices and high-value product development.

The industry's resilience and adaptability to changing dietary preferences, environmental challenges and global market dynamics will be key to its success in the years to come. With strategic planning and innovation, Japan's swine production is poised to navigate the complex agricultural landscape of the 21st century, ensuring food security and sustainability for future generations.

Productos

Bienvenido a 3tres3

Conecta, comparte y relaciónate con la mayor comunidad de profesionales del sector porcino.

¡Ya somos 153643 Usuarios!

Regístrate¿Ya eres miembro?Un resumen semanal de las novedades de 3tres3 México

Accede y apúntate a la lista